Your Guide to Smarter Investing and Financial Growth

Experience the next generation of trading platforms with powerful tools, intuitive interfaces, and expert insights to help you make informed investment decisions.

Experience the next generation of trading platforms with powerful tools, intuitive interfaces, and expert insights to help you make informed investment decisions.

Access your complete trading backoffice through WhatsApp - Get instant reports, summaries, and portfolio management at your fingertips

Get instant access to trade reports, portfolio summaries, financial statements, and more - all through WhatsApp

Leverage cutting-edge tools designed for both beginners and professionals to maximize your investment potential.

Trade in stocks, F&O, commodities, currencies, IPOs, and mutual funds — all from one platform.

Fully digital onboarding, KYC verification, and robust data protection ensure your account is safe and compliant.

Trade confidently with clear brokerage plans and zero hidden charges.

StocKart strictly follows compliance with SEBI norms, grievance redressal, and client fund protection measures.

Join thousands of happy investors who trust StocKart for expert guidance, reliability, trusted service & reliable platform

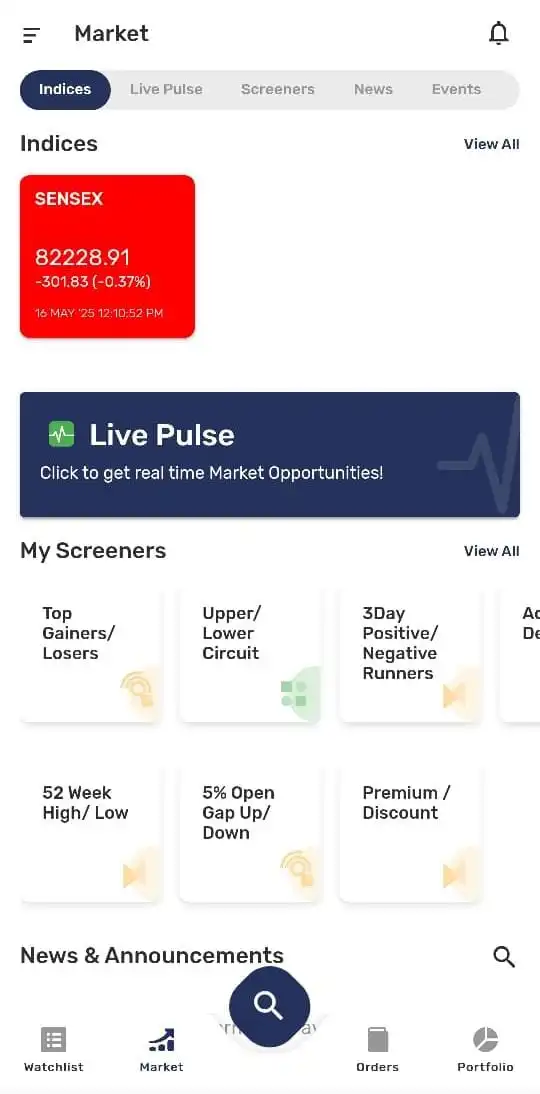

Take the power of StocKart with you. Our mobile app delivers the full trading experience with real-time data, advanced charts, and instant notifications - all in the palm of your hand.

Execute trades smoothly using our optimized mobile trading platform

Access the same powerful technical analysis tools on the go

Charts powered by TradingViewStay informed with price alerts and market-moving news

We believe in complete transparency with our pricing structure. What you see is what you pay - no surprises.

Demat + Trading Account Charges

Account Maintenance Charges

For Mutual Funds and IPOs

For Equity, F&O, Commodity and Currency Trades

* Regulatory charges and statutory levies as applicable will be charged separately.

The brokerage rate is subject to a maximum of 2.5% as per SEBI guidelines.

No. At StocKart, we believe in complete transparency. The ₹20 per order is our only brokerage charge. Statutory charges from exchanges and regulators will be clearly displayed.

An executed order means when your buy or sell order is successfully processed. You pay only ₹20 per order, regardless of the quantity or value of shares traded.

Our support team is available via live chat, email, and phone on trading days. We also offer dedicated help for premium traders and partners.

Yes, StocKart provides research-backed stock recommendations curated by our in-house market experts and analysts. We offer insights based on technical indicators, fundamental analysis, and market trends to help investors make informed decisions. However, all recommendations are for educational and informational purposes only, and users are encouraged to assess their own risk tolerance before investing.

Yes. StocKart provides a powerful mobile trading app with live market data, charting tools, watchlists, and instant order execution.

Join thousands of traders who have switched to StocKart's flat-fee model.

Use these banking details for all fund transfers to your StocKart trading account

Scan QR to pay instantly

These are the only official banking details for StocKart. Please verify these details before making any fund transfers. We will never ask for transfers to any other account. For any queries, contact our support team.

The brand name StocKart and logo are the registered trademarks of Ksn Credence Commodities Trading Pvt. Ltd. | The cost-effective brokerage plans make StocKart a trustworthy and reliable online stockbroker. Available on both the web and mobile, it offers unmatched convenience to traders. If you are considering opening a demat account online, then StocKart is just the right place for you.

StocKart, Member of Multi Commodity Exchange of India Ltd. MEMBER ID - 55805, National Stock Exchange MEMBER ID - 90358, Bombay Stock Exchange of India MEMBER ID - 6772, CDSL DP ID- 96300, AMFI Registration Number - 320687, KAZMI CHAMBERS (SECOND FLOOR), SF-01, 9A/5 PARK ROAD, HAZRATGANJ, LUCKNOW Company E-mail ID : info@stockart.co.in Investor Complaint E-Mail ID: support@stockart.co.in Compliance Officer Name : Jaswinder Singh Monga Mail ID: support@stockart.co.in, Ph. No : 0522-4026981,9389739295. Key Managerial Personnel :SHASHANK GUPTA.

FMC/Sebi Registration No : INZ000178736, CIN No. U51101UP2013PTC059797. Registered/Corporate office : Second Floor, SF-01, 9A/5, Kazmi Chamber, Park Road,Raj Bhavan Colony, Hazratganj. Lucknow UP 226001, +91 0522-4026981, info@stockart.co.in.

Investments in securities market are subject to market risks; read all the related documents carefully before investing.

Prevent Unauthorized Transactions in your demat/trading account-update your Mobile Number/Email ID with your stock broker/Depository Participant. Receive information of your transactions directly from Exchanges on your mobile/email at the end of day and alerts on your registered mobile for all debits and other important transactions in your demat account directly for NSDL/CDSL on the same day. Issued in the interest of investors.

KYC is a one time exercise while dealing in securities markets. Once KYC is done through a SEBI registered intermediary (Broker, DP, Mutual Fund etc.), you need not undergo the same process again when you approach another intermediary.

In addition to client based business, we are also doing Proprietary Trading.

Brokerage will not exceed the SEBI prescribed limit

No need to issue cheques to investors while subscribing to the IPO. Just write the bank account number and sign-in the application form to authorise your bank to make payment in case of allotment. No worries of refund as the money remains in the investor's account. For Rights and Obligation, RDD, Guidance Note

Procedure to file a complaint on Filing of complaints on SCORES — Easy & quick: Register on SCORES portal. Mandatory details for filing complaints on SCORES: Name, PAN, Address, Mobile Number, E-mail ID. Benefits: Effective Communication,Escalation Matrix Support: IG Escalation Matrix, Account Closure, SMART ODR, Complaint status Support: Complaint status Evoting Link. Speedy redressal of the grievances Click Here :- 1. RIGHTS & OBLIGATIONS, 2. RISK DISCLOSURE DOCUMENT, 3. DO'S & DON'TS,4. PRICING,5. PRIVACY,6. REFUND,7. TERMS & CONDITIONS.